🇮🇱 Israel: The West’s New Chip Powerhouse

As the U.S. and allies seek to reduce reliance on China and Taiwan for semiconductors, Israel is emerging as a key player in the global chip supply chain.

Welcome to the first edition of Israel Tech Insider. I’m Amir Mizroch, a journalist and communications advisor living and breathing Israeli tech for the past 15 years. As a former EMEA Tech Editor at The Wall Street Journal and former Director of Communications for Israeli tech NGO Start-Up Nation Central, I can connect the dots to give you a sharp, insider’s take on what’s really going on in Israel’s tech industry.

Reach out with your feedback/opinions/clarifications/gripes/slurs and comments at amir@israeltechinsider.com

More about this newsletter — More about me at amir-mizroch.com

Please consider becoming a paid subscriber so I can develop this newsletter into a must-read for anyone interested in Israel’s economy, security, and future.

In this opening edition, I’ll take you through some important, yet not widely covered or understood mega-trends shaping Israel’s tech economy.

Read My Chips: Israel Goes Full Semi

Techsodus: The Fewer Humans of Startup Nation

Israel is a cyber power, right? Right??

A new “Cyber for AI Language Models” is taking off.

Who amongst us doesn’t have an Adam Neumann in them?

The Art of the Deel: Global workforce startup CEO Alex Bouaziz goes AWOL to evade Paris bailiffs in spy case

Opportunities

Read My Chips

🇮🇱 Israel: The West’s New Chip Powerhouse

America's semiconductor strategy has found a new front. As Washington frets about Taiwan's vulnerability and China's technological ambitions, Israel is quietly transforming from talent pool to strategic asset. Three developments this past week highlight how Israel is becoming critical to Western technological sovereignty.

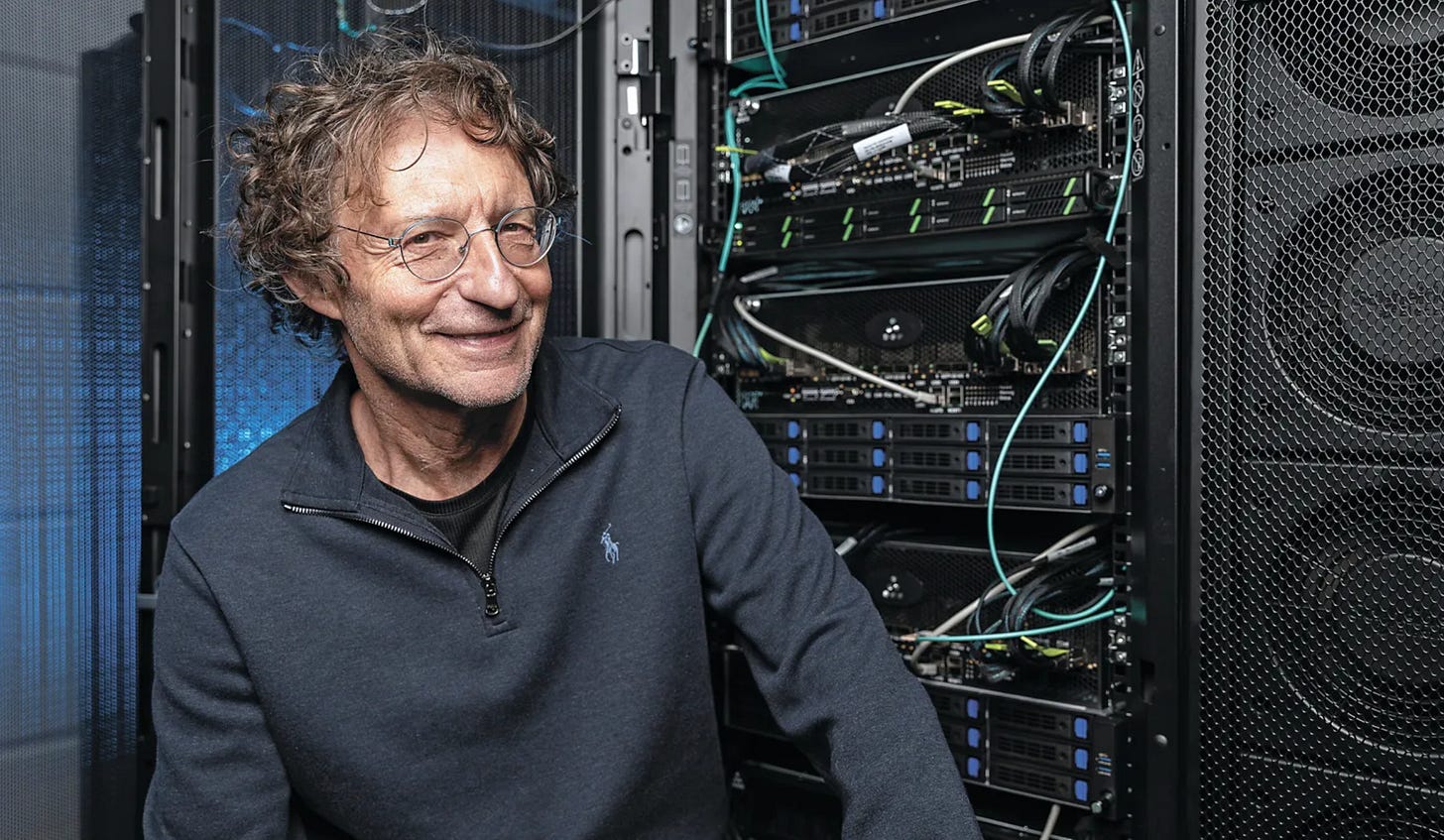

First, Element Labs has secured $50m in funding at a $500m valuation for its AI-optimized processors—a direct challenge to Nvidia's hegemony. The startup was founded by Avigdor Willenz, Israel's most prolific chip entrepreneur, whose track record is nothing short of extraordinary. His previous ventures became strategic acquisitions for technology giants: Galileo Technologies (sold to Marvell for $2.7bn), Annapurna Labs (to Amazon for $370m), and Habana Labs (to Intel for $2bn). Willenz’s run reveals systematic integration of Israeli chip design into Western tech infrastructure. The startup’s backers—Fidelity Investments and Gavin Baker’s Atreides Management—clearly see immense value in AI-tailored hardware and Willenz’s ability to build it.

Meanwhile, Apple's semiconductor chief, Johny Srouji—a Haifa native and the firm's highest-ranking Israeli executive—made a pointed visit to the company's R&D centers in Herzliya and Haifa last week. These facilities are instrumental to Apple's silicon independence strategy, working on the custom chips that have liberated the firm from Intel's grip. That Apple places such critical work in Israel speaks volumes about the country's strategic importance.

Adding to the momentum, Retym (pronounced re-time) emerged from stealth mode with $180m in investment. The Israeli-American startup, co-founded by Roni El-Bahar (formerly of Huawei, Samsung and Intel), develops specialized digital signal processing chips for data centers and telecommunications. Its half-billion dollar valuation and backing from premier venture firms Spark Capital, Kleiner Perkins and Mayfield Fund demonstrate that investors are watching Israeli chip talent closely.

Why now? As Taiwan's semiconductor vulnerability becomes America's strategic nightmare, and China pours billions into achieving chip self-sufficiency, Western tech giants are urgently reconfiguring their supply chains. Israel offers a perfect combination: world-class engineering talent, geopolitical alignment with Washington, and geographic distance from China's sphere of influence.

Some background context: Since Intel planted its flag in 1974, Israel has cultivated a semiconductor ecosystem that now employs 45,000 people across 200 companies. Though the country lacks the manufacturing heft of Taiwan or South Korea, it has carved out strategic positions in the global chip value chain that belie its size.

The industry's core strength lies in design. Three-quarters of Israel's semiconductor workforce develops the architecture for chips that eventually power everything from smartphones to data centers. Intel, Nvidia, Apple, and others maintain substantial design centers, employing the lion's share of this talent. Israeli firms' repeated appearances in acquisition headlines—think Mobileye ($15.3bn) and Habana Labs ($2bn)—testify to their innovation capacity.

Perhaps more significant is Israel's outsized presence in metrology and inspection—the sophisticated tools that ensure semiconductor manufacturing precision. This segment employs just 16% of the country's chip workforce but handles an estimated third of global chip inspection processes. Companies like Applied Materials, KLA-Tencor, and homegrown Nova provide the critical quality control without which modern chip fabrication would be impossible.

This positioning appears increasingly valuable as geopolitics transforms semiconductor supply chains. While South Korea plans to invest $470 billion by 2047, China commits $150 billion, and America allocates $278 billion through its CHIPS Act, Israel has been quietly building its specialized niche for decades. The strategic calculation is straightforward. As advanced economies vie for "silicon sovereignty," specialized knowledge becomes as valuable as manufacturing capacity. Israel cannot match Taiwan's production scale, but its expertise in designing and inspecting the world's most advanced chips gives it leverage disproportionate to its size.

The big question now is whether it can maintain this advantage amid intensifying global competition for chip supremacy. That’s not going to be easy, especially given the next item on the agenda…

///

Techsodus: Movement of the Talented People

Israel's vaunted tech sector, long the engine of its economic growth and a source of national pride, is shrinking. For the first time in a decade, the country has fewer technology workers than the year before. The Innovation Authority's 2025 Human Capital Report reveals a sector not merely stagnating but contracting—a development with implications stretching far beyond its innovation hubs in Tel Aviv and Herzliya.

Some 8,300 tech employees—2.1% of the tech workforce—departed Israel between October 2023 and July 2024, contributing to an overall decline of 5,000 workers in the sector. The timing is hardly coincidental. The confluence of war, political instability and escalating living costs has accelerated what was already an incipient trend. Many Israeli technologists, whose skills are globally portable, have voted with their grandparents’ foreign passports or attractive relocation packages and Sponsored Visas.

More significant than the headline numbers is the structural shift they represent. Israeli tech firms now reportedly employ more people abroad (440,000) than domestically (400,000). Even in research and development—long considered Israel's core competitive advantage—Israeli companies now place half their staff overseas. Is the country's celebrated innovation ecosystem increasingly going to resemble a sort of Outsource Nation — a command center for a globally distributed workforce— rather than Startup Nation, a self-contained technology hub?

If it continues, the current "Techsodus" threatens the economic model that transformed Israel from an agricultural society into a high-tech powerhouse. The sector generates 20% of GDP and more than half of exports. Its outsized contribution to tax revenue has sustained public spending during repeated security crises. Should the talent drain continue, the economic implications would extend well beyond the industry itself.

Global tech firms watching this may reconsider their Israeli operations. Companies like Apple, Google and Microsoft have established substantial R&D centers in Israel precisely because of its talent concentration. If that advantage erodes, the economic multiplier that these multinational presences create could diminish as well.

Israel's predicament offers a cautionary tale for other tech hubs. When political instability combines with portable skills and global demand, even the most entrenched innovation ecosystems can unravel with surprising speed. For a nation whose technological prowess has been central to both its economy and security, the stakes could hardly be higher. Startup Nation's next challenge is retaining the very people who built it.

For some color on this, I spoke with a European tech investor operating out of Cyprus, who told me the island nation is actively courting Israeli tech companies and creating an attractive ecosystem for them to establish a presence. He said he is seeing a growing stream of Israeli startups setting up shop in Cyprus, which is under an hour flight time from Tel Aviv. Cyprus offers tax advantages for subsidiaries, potentially allowing Israeli companies to establish a European base with favorable tax treatment. Cyprus is particularly interested in Israeli technologies in areas like Desalination, Energy storage, Renewables, Cyber security, Deep tech and AI. They also have great weather, and a new Jewish school is set to open there in the coming years.

////

Israel is a cyber power, right? Right??

Wrap your firewall around this:

A data security mega-lapse exposed the name, national identification number, and current phone number of every active career soldier in the Israel Defense Forces (IDF). The breach occurred via a third-party ticketing platform, Ticketek, used by the military to offer theater tickets to service members. The platform lacked basic security measures like two-factor authentication or controls against automated data extraction. You know, table stakes stuff.

Ticketek says it had recommended stronger authentication but the client, presumably the IDF, opted against it!! Thankfully Israeli journalist Ran Bar-Zik, who was “visiting” an enemy state’s internet via VPN, discovered the flaw and reported it to the IDF, who subsequently rectified the issue. This is what Bar Zik writes:

“I’m tired of finding databases like this while I’m browsing with VPNs from shady countries. Maybe it’s time for the army to stop sending lists of soldiers to companies without someone who understands cybersecurity talking to the third party to ensure the data doesn’t leak and is properly destroyed as required. These databases are dangerous.”

But wait! It gets worse! Here’s a fascinating and scary piece by journalist and friend of Israel Tech Insider Milan Czerny on how Iran-affiliated hacker groups have exploited vulnerabilities in Israel’s digital infrastructure— despite the country’s reputation as a cyber security powerhouse. It’s simply insane that an army with thousands of cybersecurity experts, and a nation with thousand of cybersecurity startups, falls down on such basic stuff. Now if we could just find a few cybersecurity companies who could take a look at this for us. Where could those be?

///

WIRED: GENERATIVE ENGINE OPTIMIZATION (GEO)

TIRED: SEARCH ENGINE OPTIMIZATION (SEO)

EXPIRED: ORGANIC TRAFFIC (HUMAN WRITERS)

Israel is becoming a power in a new kind of cyber

Apart from protecting against hacking and data leaks (sometimes), a new Israeli cyber industry is growing fast: protecting users against the threats coming from Generative AI like ChatGPT and others. There are several distinct sectors here, I’ll cover just 2 for now (but will come back to this in future newsletters):

Helping enterprises build and run secure AI software

Helping brands appear (safely) on AI search and protecting their reputations

Let’s take a look first at #1, Cyber for Large Language Models (LLMs) with the news this week that Pillar Security, an AI security startup founded by Dor Sarig and Ziv Karliner, raised $9 million in Seed funding. The round was led by Shield Capital, the fund of Dan Caine, who is now the US Military’s Chairman of the Joint Chiefs of Staff (how often does that happen?!). Other investors include Golden Ventures, and Ground Up Ventures. The company addresses risks like evasion attacks, where adversaries subtly manipulate inputs to fool AI models, as well as data poisoning and intellectual property leakage—areas where traditional cybersecurity tools often fall short. Qualifier AI, which prevents the entry of malicious content into LLMs via prompts, is another hot startup in the space. Qualifier’s software also reduces those AI chatbot hallucinations. The company was recently selected for Google’s Growth Academy: AI for Cybersecurity.

Now let’s look at the second kind of new cyber for LLM brand protection, with the news that Brandlight, a Tel Aviv startup that helps brands influence how they appear in AI-generated content, this week raised $5.75 million led by Cardumen Capital and G20 Ventures. Additional investors and advisors include Tony Weisman (former CMO of Dunkin’ and former CEO of Digitas), and David Edelman (Harvard Business School). As consumers increasingly rely on AI-powered tools to search for products and services, traditional methods for getting noticed online—like classic Search Engine Optimization (SEO)—are losing their impact. This is leading to the birth of a new industry called Generative Engine Optimization (GEO), and there are some interesting new Israeli startups in the space. Instead of focusing on keywords, their technology allows companies to see, measure, and improve how they appear in AI-generated results, aiming to ensure that when consumers ask AI what to buy, their clients’ products are the ones that get recommended. According to Uri Gafni, Brandlight’s co-founder: "Young people don't use Google anymore - they search with ChatGPT. The traditional search is dead. This change is happening very fast."

///

Shifting gears now from the Macro to the Ego, here is a tale of Chutzpa in 2 parts

Chutzpa Story Part 1: A Neu-mann is Born

There’s an Adam Neumann inside every one of us. Or at least that’s the key message in Adam Neumann’s new PR push to rehabilitate his image on Israeli TV. Neumann, co-founder and sole-destroyer of WeWork, is possibly Israel’s most infamous tech messiah. He built WeWork into a $47 Billion office rental and spiritual wave pool company, and left it in bankruptcy.

“No doubt, the success went to my head,” says the humbled entrepreneur, on a humble balcony, with an empty designer pot plant (??) in the corner.

TheMarker tech reporter Ofir Dor calls Neumann’s "it went to my head" statement the "understatement of the century.” He’s not wrong.

Chutzpa Story Part 2: The Art of the Deel

Hide and CEO: Global Workforce Startup Founder In Cross-Border Disappearing Act

Oh the delicious irony: An Israeli-American HR tech firm that promises to streamline global hiring for companies with international workforces finds its own CEO impossible to locate. French bailiffs have failed to serve Deel CEO Alex Bouaziz at his Paris address, while his LinkedIn profile places him in Tel Aviv and his X profile has him in NY. Bouaziz, whose company promises seamless global workforce management, faces allegations that his company paid an employee at rival firm Rippling $6,000 monthly to spy on Rippling’s Slack channels. Bouaziz is now reportedly in Dubai, along with Deel’s general counsel Asif Malik, whom Rippling is also trying to serve. For a firm whose business model depends on navigating international compliance, Deel's leadership exhibits remarkable skill at exploiting the very jurisdictional complexities they sell solutions to overcome. As Rippling now seeks permission for email service—a last resort in transnational litigation—one wonders if Bouaziz appreciates that a CEO who cannot be found sends precisely the wrong message about a company that promises to help clients locate talent worldwide.

Opportunities

The Israeli government is exploring the creation of specialized investment funds to boost the country's defense technology sector. The initiative, jointly led by the Finance Ministry and the Defense Ministry's research arm (MAFAT), aims to channel capital into innovative military technology startups and projects. The government is currently seeking information from potential stakeholders before finalizing the program. Interested parties can submit responses until May 8, 2025. More details are available on the government portal.

The Israel Innovation Authority invites Israeli companies and researchers in the semiconductor field to join the CHIPS JU 2025 program. With a €3.5M budget, this call supports collaborative R&D with European partners, focusing on chip design innovation. Submission deadlines: May 6, 2025 (first phase), and September 21, 2025 (second phase). For details, visit Innovation Israel CHIPS JU Call.

///

That’s it for this edition, please let me know what you think, and what you’d like to see more of. amir@israeltechinsider.com

See you here next week.

Amir.

I really enjoyed reading the first edition and I am looking forward to the next one !