European defense policy since the end of WW2 has gone something like this: Most people agree it’s important, but we don’t want to do it ourselves. Russia’s invasion of Ukraine and the ensuing war has shaken that view. But what is really focusing the minds of Europe’s military chiefs is not North Korean troops in Russia’s army, it’s America’s Pivot to Asia, and with it, American security guarantees that two generations of Europeans have taken for granted.

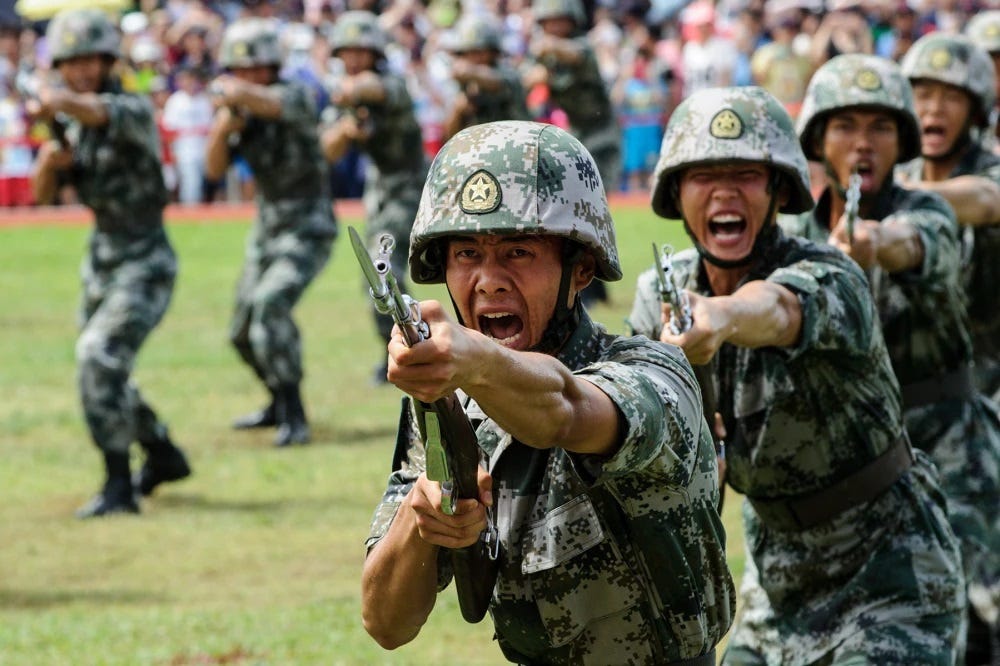

The US Pacific Pivot has been a long time coming. Several American presidents have tried and failed. But Chinese President Xi’s order for The People’s Liberation Army to be ready to “liberate” Taiwan by 2027 has put a HOLD FOR WAR WITH CHINA in the Pentagon calendars.

Despite bluster from the Trump White House about buying Greenland, controlling the Panama Canal, annexing Canada, and turning Gaza into Dubai 2.0, astute observers say America's strategic attention remains “very, very, very” locked on Asia. The US has taken the first step in fixing its military’s China problem: admitting it has a problem. The US is not ready for a war with China by any stretch of the imagination. There’s a severe lack of capabilities in terms of ship building, ammunition, and autonomous systems.

The implications go far beyond defense. Industry experts warn that any disruption to Taiwan's semiconductor production could set global technology back 15 to 18 years. It could brick everything from laptops and phones to robot vacuums and smart dildos for over a decade. Imagine the device you have now being the last device you’ll own.

European military leaders, more of an observer force than active participants in the defense of their own democracies, are starting to understand that yes, the Americans are really doing this. Freedom is not Cap-Ex free. The immediate upshot: laying bare the fact that most military innovation used in Europe is Made in the USA.

Beijing, Washington DC, Kiev, Silicon Valley and Tel Aviv are shaping the future of war. Brussels, the seat of the European Union, is the global capital of “Not Invented Here”, pouring all its energy into legislation against innovation. Europe as a whole lacks a defense ecosystem for smaller companies to innovate in. Its defense industrial base supply chains are fragile. There aren’t enough non-Chinese vendors for Chinese-made drone components that European militaries still use.

This double jeopardy --vulnerability in semiconductors and defense innovation--should be shattering entrenched assumptions and reshaping old patterns across Europe. The closer one gets to the Ukrainian frontline, the more these pennies are dropping, and the more military spending rises. Poland leads NATO in military spending, nearing 5% of GDP. German generals, once reluctant even to discuss open conflict, now predict war within 4-6 years. 5,000 German troops are heading to Lithuania—a deployment unthinkable a decade ago.

Still, the contrast in innovation speed between regions is stark. European defense procurement systems were built on a triangle of time, quality, and costs. Built To Last, not Built To Adapt. Military innovation still struggles to break through. Drone R&D programs exist, but they remain detached from frontline military needs. A major drone project in Germany ran for four years without embedding into the German army’s operational structures. By the time decision-makers recognized its utility, the project was over.

Access to European end-users requires navigating complex bureaucracies that can take months. Solutions tailored for European Special Operations Forces are often not applicable to their wider militaries. In contrast, Ukrainian teams can demo changes to end users within 48 hours. The further into Western Europe you go, the slower defense innovation becomes. The UK’s military is “unfit for purpose”. Palantir and SpaceX sued the US government for years to gain access to Department of Defense contracts. Europe doesn’t have that time.

The new wave of software-defined defense startups brings with it a new business model and new modes of production. Instead of a few exquisite, expensive platforms, masses of cheap, expendable, adaptable, and autonomous platforms that can update several times a week, if necessary. The goal, the actual goal, is to constantly lower the cost of new systems and the time it takes to deploy them. If you want to come out on top, you have to race to the bottom. That’s the whole story: agile development of software-defined military-specification (MIL-SPEC) systems. Big defense companies and sclerotic militaries don’t work that way.

Israel's position is particularly complex, given its unique geographic and political environment. Its special relationship with America isn't likely to change, but what probably will change is America’s capacity to actually execute on that special relationship, as US diplomatic and military resources will be stretched to the limit.

Yet Israel holds a potential Trump card: a deep bench of semiconductor talent and an Intel chip fab. In a world desperate for chips--and chip sovereignty-- this is leverage. But even here, an over-reliance on an American tech giant that is itself in the most tumultuous period in its history, points to tiny Israel’s vulnerability in securing a steady supply of semiconductors.

On the optimistic side, a chastened Israeli military industrial complex that had its ass handed to it on Oct 7—and is now innovating at war speed—is a potential middle path between European stability and Ukrainian speed. The vibe now inside the IDF is on practical solutions that can be deployed quickly while maintaining military-grade reliability. It’s ‘move fast and break the enemy’s things’; shoot first and open a Jira Ticket later.